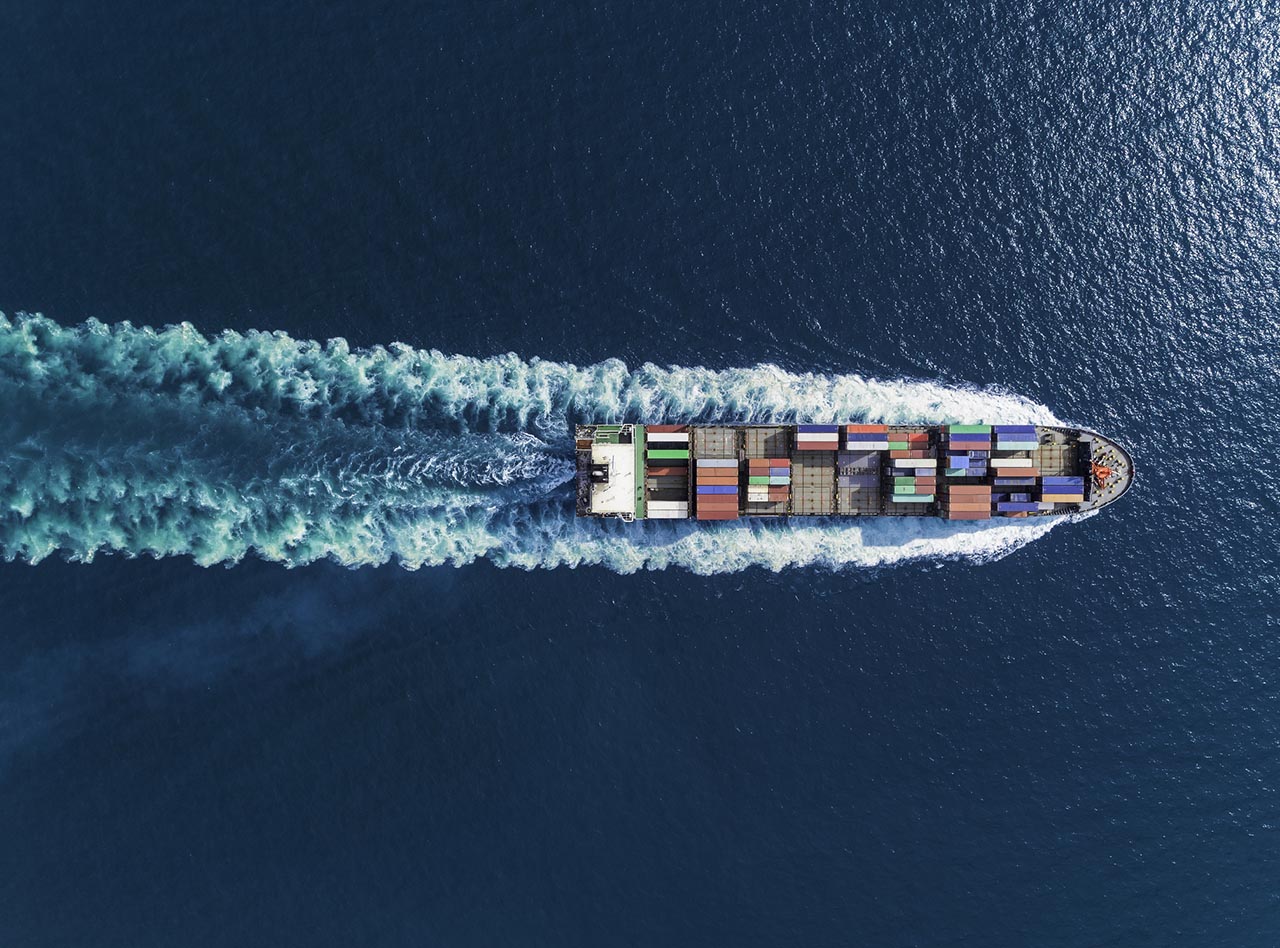

As a business owner it’s never been more important to ensure that you have an effective supply chain in place. We understand that successfully navigating and managing the risks presented by a supply chain that could span across borders is becoming more complex. Just one of the ways you could look to reduce your exposure is to transfer your risk through purchasing appropriate insurance cover - Marine Cargo insurance is just one type of insurance that could help you.

Consult one of our expert advisors to learn more about cargo insurance. They’re on hand to provide advice and professional recommendations for an insurance policy that meets your needs.